unfiled tax returns 10 years

However you risk losing a refund altogether if you file a return or otherwise claim a refund after the statute of limitations. The minimum penalty is the smaller of the tax due or 135.

Can The Irs Take Or Hold My Refund Yes H R Block

Prepare the Returns You cannot file an older year return using the current year tax forms and instructions.

. The statute of limitations for the IRS to collect taxeswhich is generally ten yearsalso doesnt begin until you file your return. There is no statute of limitations on unfiled returns. This penalty is 5 per month for each month you havent filed up to a maximum of 25 over 5 months.

Heres what to do. In fact there is a statute of limitations that applies to collections by the IRS but it only pertains to taxpayers who have. Whatever the reason once you havent filed for several years it can be tempting to continue letting it go.

10 Years of Unfiled Tax Returns Client informed DeWitt Law that they had not filed a federal income tax return since 1995. The good news is that the IRS does not require you to go back 20 years or even 10 years on your unfiled tax returns. In most cases the IRS requires you to go back and file your.

However in practice the IRS rarely goes past the past six years for non-filing enforcement. Many folks believe that the IRS cannot take action against them if 10 years have passed since they last filed a tax return. Theres no penalty for failure to file if youre due a refund.

DeWitt Law prepared Clients tax returns and represented Client. My older brother hasnt filed taxes for 10 years. For taxpayers who havent filed in previous years the IRS has current and prior year tax forms and instructions available on the IRSgov Forms and Publications page or by calling toll-free 800.

Get all the information needed to file the past-due return. If you owe money and do not file your taxes the IRS will assess a failure to file penalty which is 5 of the back taxes owed per month the return is late up to a maximum of. However not filing taxes for 10 years or more exposes you to owing steep.

If you fail to file your taxes youll be assessed a failure to file penalty. I keep telling him thats its only a matter of time before it catches up to him. The Statute of Limitations Only Applies to Certain People.

Start by requesting your wage and income transcripts from the IRS. This is because the tax law changes from year to year and some of the. If you havent filed a return the IRS can go back to any time period and assess a tax against you.

How to file back tax returns 1. The IRS has some conflicting information when it comes to several years of unfiled tax returns. We evaluate all of your options which.

However once the tax has been. What is the best way to file your missing back taxes. It is true that the IRS can only collect on tax liabilities that are 10.

The IRS can go back to any unfiled year and assess a tax deficiency along with penalties. That means the IRS has more time to seize your assets for. A single person making up to 12k in.

10 years of unfiled taxes. The late fining penalty for a C-Corporation is 5 of the outstanding tax for up to five months.

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

10 Or More Years Of Unfiled Tax Return A Guide On How To Resolve It Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

What Happens If You Don T File Taxes For 10 Years Or More Findlaw

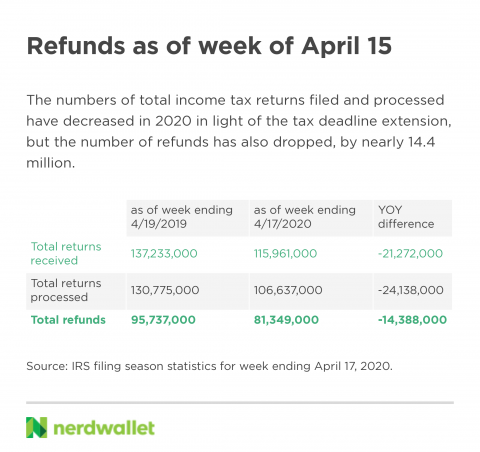

Irs Data Refunds Lag As Agency Tax Filers Slow Down Nerdwallet

What Should You Do If You Haven T Filed Taxes In Years Bc Tax

Unfiled Tax Return Information H R Block

Here S Why Your Tax Return May Be Flagged By The Irs

Unfiled Tax Return Penalties Can Be Very Expensive Make This Your First Step Hellmuth Johnson

Delinquent Or Unfiled Tax Return Consequences For Irs Taxes

Haven T Filed Taxes In Years What You Should Do Youtube

Best Way To Catch Up On Unfiled Tax Returns Back Taxes

Unfiled Tax Returns 101 I Peter E Alizio Cpa Esq

Irs Tax Notices Explained Landmark Tax Group

Irs Audits With No Time Limit And No Statute Of Limitations

4 Ways That Unfiled Tax Returns Can Haunt You Tax Defense Network

Unfiled Tax Help What To Do With Multiple Unfiled Tax Returns Tax Resolution Professionals A Nationwide Tax Law Firm 888 515 4829

20 Years Or More Of Unfiled Tax Returns Here S What You Do Youtube

4 Consequences Of Unfiled Tax Returns Jld Tax Accounting

What Should You Do If You Haven T Filed Taxes In Years Bc Tax